2015’s personal insolvency figures, issued today, Friday 29 January 2016, show that the number of people becoming insolvent is continuing to go down. In particular, bankruptcy, the most onerous and least forgiving formal debt solution continues to drop in usage.…

Continue reading the "Is this the end for bankruptcy?" »

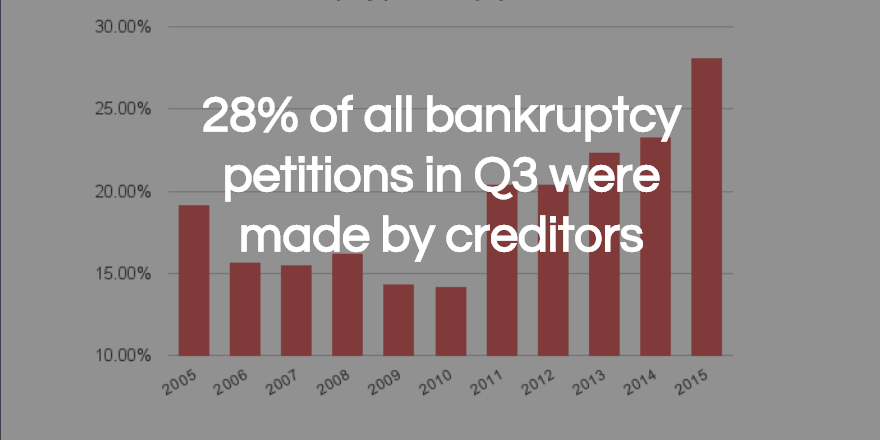

Quarterly figures released today by the Government’s Insolvency Service show that total personal insolvencies rose in the third quarter of 2015, for the first time since the second quarter of 2014. That increase is entirely due to rising numbers of…

Continue reading the "IVAs still rising in popularity Government figures show" »

The personal insolvency figures released yesterday by the Government’s Insolvency Service show a continuing fall in the number of people who need to use a legal process to deal with their debts. However, as always, it’s when you look behind…

Continue reading the "Personal insolvencies are at a 10 year low but DROs are on the rise" »

At ClearDebt we believe an Individual Voluntary Arrangement (IVA) is often a much better solution to becoming debt free than even a free Debt Management Plan from a charity like StepChange. Our IVA infographic gives you the basics about IVAs and…

Continue reading the "Want to know more about why an IVA can be better than a Debt Management Plan?" »

Given that there are almost 46.5 million voters in the UK and 8.8 million (roughly one in five) of them have debt problems, it always strikes us that governments do not pay enough attention to the problems of people in…

Continue reading the "What will the Conservatives do to deal with personal debt?" »

The latest figures from the Government’s Insolvency Service suggest we’ve turned a corner, but perhaps it’s not the obvious one. Look at this first graph. Total personal insolvencies are down. OK, they are still roughly twice as high as they…

Continue reading the "Is this the end of the debt management plan (even free ones)?" »