Newsdesk archives

IVAs are becoming more popular debt solutions than DMPs – we think new government figures show this.

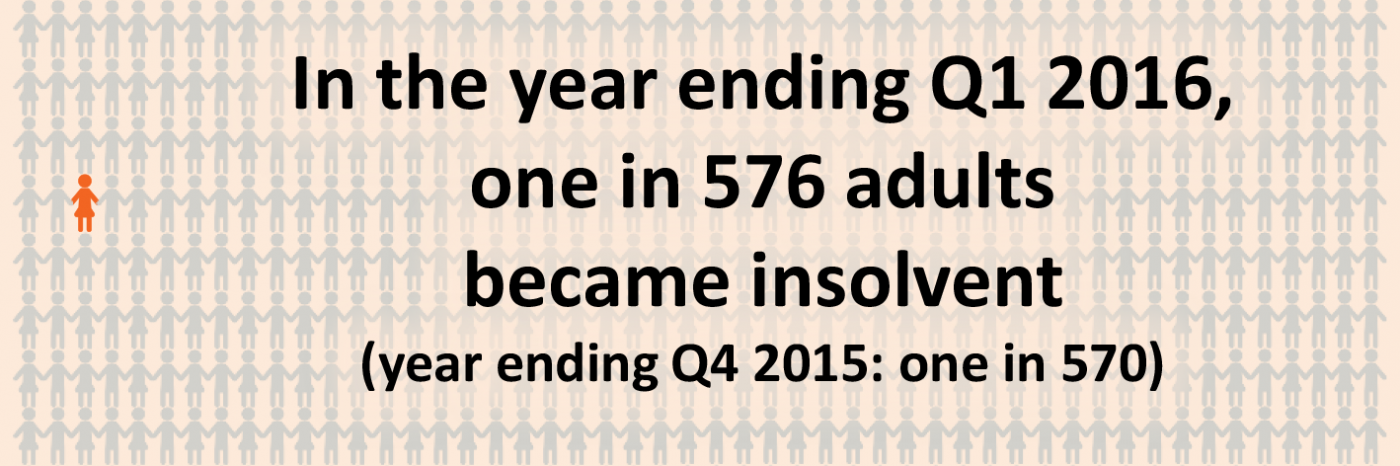

Today’s figures from the Insolvency Service show Individual Voluntary Arrangements (IVAs) rocketing away as the most used formal debt solution in England and Wales. And, driven by IVAs, the number of people choosing to deal with their debt through personal…

Why ClearDebt’s IVA Calculator really can show you how much less you could pay in an IVA

Could you eat your debt in Big Macs?

Back in July 2010 the average Brit owed £4,513 in credit cards and unsecured loans. That’s according to statistics compiled by The Money Charity. In July 2016 the same average person owed £3,695. That’s a fifth less. So the amount we…

Continue reading the "Could you eat your debt in Big Macs?" »

The rise and rise of the IVA: Latest insolvency debt statistics

Here at ClearDebt we have been saying for some time that Individual Voluntary Arrangements) (IVAs) have become the procedure of choice for those people who have debts they can’t pay and a regular income to enable them to make contributions…

Continue reading the "The rise and rise of the IVA: Latest insolvency debt statistics" »

DROs and IVAs rule the roost

Whilst the number of people choosing insolvency to deal with their debts went up in the first three months of this year, the number going bankrupt is now the lowest since 1990, as shown by government figures released today (Friday…