Personal debt statistics from Payplan reveal Essex to be top of the tree when it comes to personal debt. But if you compare their figures to the average wage for each area to give a debt to wage ratio, the picture…

Continue reading the "Debt uncovered: The highest average personal debt in the UK" »

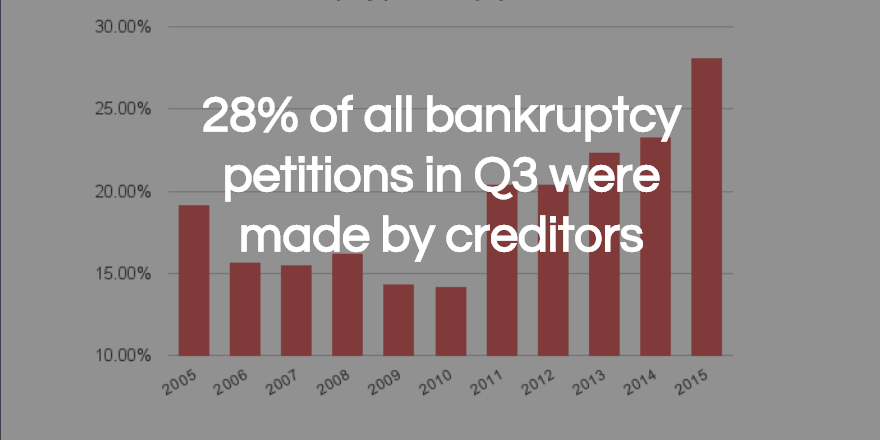

Quarterly figures released today by the Government’s Insolvency Service show that total personal insolvencies rose in the third quarter of 2015, for the first time since the second quarter of 2014. That increase is entirely due to rising numbers of…

Continue reading the "IVAs still rising in popularity Government figures show" »

The personal insolvency figures released yesterday by the Government’s Insolvency Service show a continuing fall in the number of people who need to use a legal process to deal with their debts. However, as always, it’s when you look behind…

Continue reading the "Personal insolvencies are at a 10 year low but DROs are on the rise" »

The staggering amount of personal debt in the UK is likely to surprise many people. Our infographic takes a closer look at the figures ahead of Thursday’s General Election. Britain may be out of the economic downturn and seemingly back…

Continue reading the "Britain’s personal debt and what the General Election could bring" »

The latest figures from the Government’s Insolvency Service suggest we’ve turned a corner, but perhaps it’s not the obvious one. Look at this first graph. Total personal insolvencies are down. OK, they are still roughly twice as high as they…

Continue reading the "Is this the end of the debt management plan (even free ones)?" »

The Insolvency Statistics today show some 99,196 personal insolvencies were recorded in 2014, which is the first time the total has dropped below 100,000 since 2005. This represents a 1.8% fall in personal insolvencies compared to 2013, the lowest it…

Continue reading the "IVAs hit an all-time high" »