2015’s personal insolvency figures, issued today, Friday 29 January 2016, show that the number of people becoming insolvent is continuing to go down. In particular, bankruptcy, the most onerous and least forgiving formal debt solution continues to drop in usage.…

Continue reading the "Is this the end for bankruptcy?" »

The January blues are long and tough. When the festive madness is over money is inevitably tight and it can seem that payday is an eternity away. In fact, my experience is that, even though the papers and the telly…

Continue reading the "Changing Habits, Cutting Costs." »

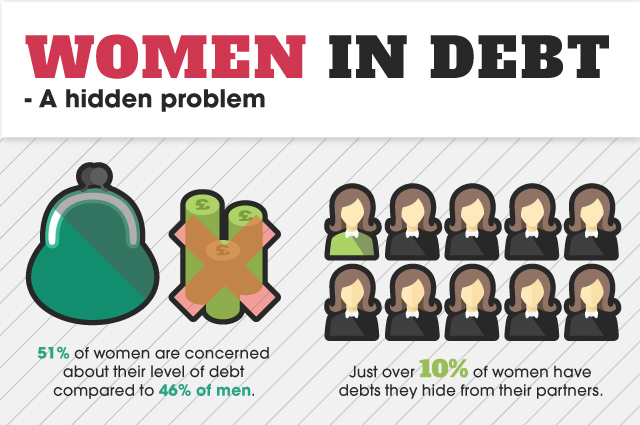

In the 45 years since the Equal Pay Act was formed, have we really moved on that far in terms of pay equality? This week the focus is on Living Wage week but, if we cannot sort out the issue…

Continue reading the "Wage Equality: Are women still getting a raw deal?" »

There are vastly different behavioural patterns between men and women when it comes to personal debt. Men and women are still treated differently in many ways, despite 30-plus years of progressive law making, but two thirds of women across the…

Continue reading the "Woman in Debt: A hidden problem" »

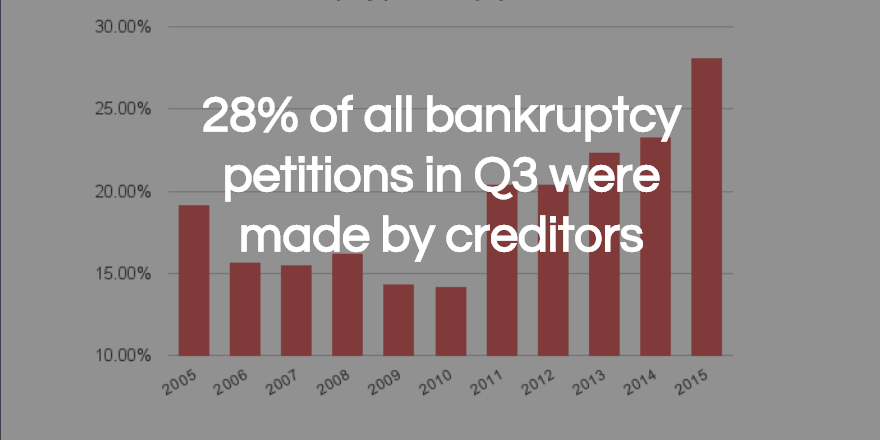

Quarterly figures released today by the Government’s Insolvency Service show that total personal insolvencies rose in the third quarter of 2015, for the first time since the second quarter of 2014. That increase is entirely due to rising numbers of…

Continue reading the "IVAs still rising in popularity Government figures show" »

The personal insolvency figures released yesterday by the Government’s Insolvency Service show a continuing fall in the number of people who need to use a legal process to deal with their debts. However, as always, it’s when you look behind…

Continue reading the "Personal insolvencies are at a 10 year low but DROs are on the rise" »